It’s often been said that a diamond is a girl’s best friend. In the past, this phrase might have applied because diamonds were seen as rare and valuable due to the inefficiencies of diamond mining. However, over the last century and with an increasingly sophisticated market, diamonds have become one of the most sought-after gems on earth.

(Image Source: Ehud Arye Laniado)

In recent decades there has been a significant change in how people can purchase these high-end gems for themselves or for their loved ones. Nowadays, it is possible to purchase a rough diamond from an online store and then send it off to be cut into whichever shape you desire at one of their many cutting factories around the world.

Most diamonds are now sourced from three regions: Brazil, Botswana and South Africa. These are the world’s leading diamond producers. Interestingly, these three countries have a history of conflict with one another.

Botswana is the oldest of the three major diamond-producing countries and has a rich natural treasure trove that provides an abundance of value-added minerals like copper, gold and manganese, as well as uranium. In order to curb smuggling incidents within the country’s borders, the government imposed stringent import regulations for all rough diamonds when it entered into an agreement with De Beers in 1964.

South Africa was the last of the three major producers to enter into an agreement with De Beers. The South African government’s main concern was that diamonds were being exported without a “clawback,” or value-added tax, and therefore it would not receive the country’s fair share of revenue derived from diamond sales. The two countries negotiated a 50/50 arrangement between De Beers and the South African government to manage and control this keystone gemstone industry.

Brazil, on the other hand, has no such formal agreement with De Beers. Instead, it is one of many countries in Africa that suffer from illegal diamond mining among their own citizens; some estimates put that number as high as 20%. In order to combat this illegal diamond mining, the Brazilian government has imposed a sales tax of 17%.

De Beers, in turn, controls all rough diamond sales through their online catalogue. They sell these gems at fixed prices within their network of cutting factories around the world. It’s important to note that the online auction system is not online and it is not possible to bid on them from anywhere but the De Beers website.

Also, it must be noted that the price set by De Beers is only a starting point in the transaction process. The price that buyers receive for their diamonds will be influenced by many variables such as the quality of each diamond in question and how much weight each stone has (this is measured in carats).

Technology has changed the high-end market by allowing smaller diamond producers to access a whole new market that was previously off limits to them. This same technology has also made it easier for consumers to communicate directly with these smaller diamond producers and purchase products at better prices than they would get from De Beers.

In order to combat this, De Beers has opted for a more hands-on approach to steer the industry in their favour. For example, when one of their clients was unhappy with the quality of diamonds provided by De Beers, they reached out personally to provide another solution. In other cases, De Beers has started marketing its own exclusive brands such as Namita (which is named after the wife of its CEO).

The high-end watch market has also been terraformed by the introduction of technology as more and more smartwatches are created with additional features such as GPS tracking and a built-in camera. It has been widely reported that the price of these smart watches has surpassed the price of traditional watches. The future looks bright for the high-end watch market, and this will undoubtedly change the way people buy, sell and store their timepieces in the years to come.

Newer advances in technology helped companies like Amazon and other tech giants to price aggressively, compete with luxury brands, and create their own products.

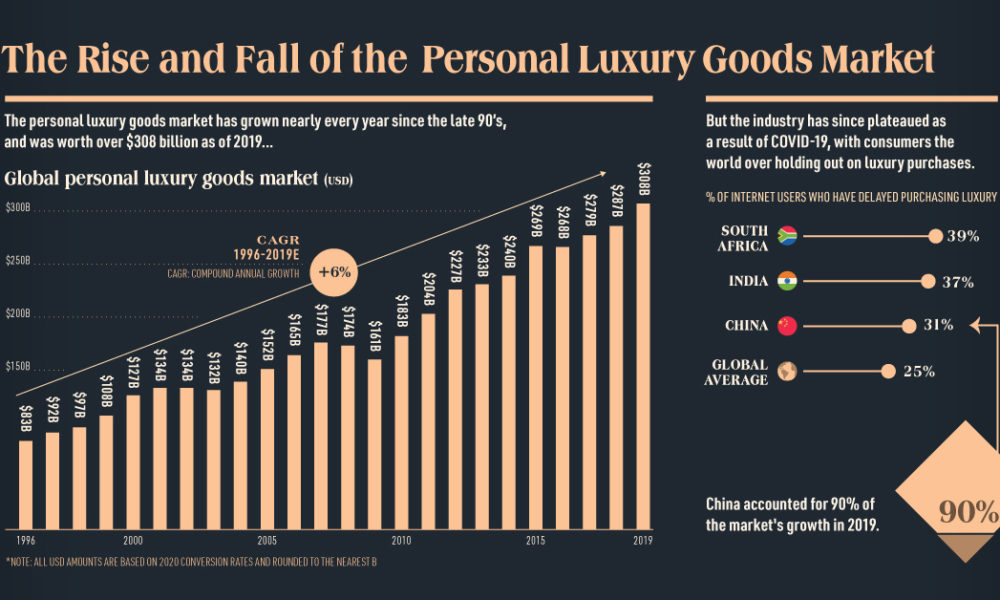

The “old rules” of retail pricing are quickly disappearing as competition from e-commerce heats up. There are now more ways for consumers to purchase luxury goods than ever before – directly from the original manufacturer or via websites like Amazon – which has given birth to an entirely new category of shoppers known as “luxury digital natives.”

According to a survey conducted by Retail TouchPoints, 20% of online shoppers who were born after 1990, identify as “luxury digital natives,” meaning they are more likely than others to be shopping via mobile devices and they rarely visit physical stores. And according to an article in the New York Times, a survey found that only 13% of these consumers had visited a conventional store in the last year.

(Image Source: Visual Capitalist)

This translates into less traffic and profitability for physical retailers, but this phenomenon benefits consumers who can now take advantage of competitive pricing that was previously unattainable because all the variables were controlled by the brands, or not available at all due to low market penetration.

The luxury digital natives have access to price transparency, instant delivery, a broad selection of products, and the ability to return purchases at little or no cost. What’s more, is that these consumers are used to instantaneous feedback and service which makes them critical of those brands who can’t seem to keep up with their expectations.