The cryptocurrency market is in a dip, which some investors will relish while others will find it tough to bear. A recent report by The Wall Street Journal says that the freeze in crypto could lead to a plunge of 75% within days.

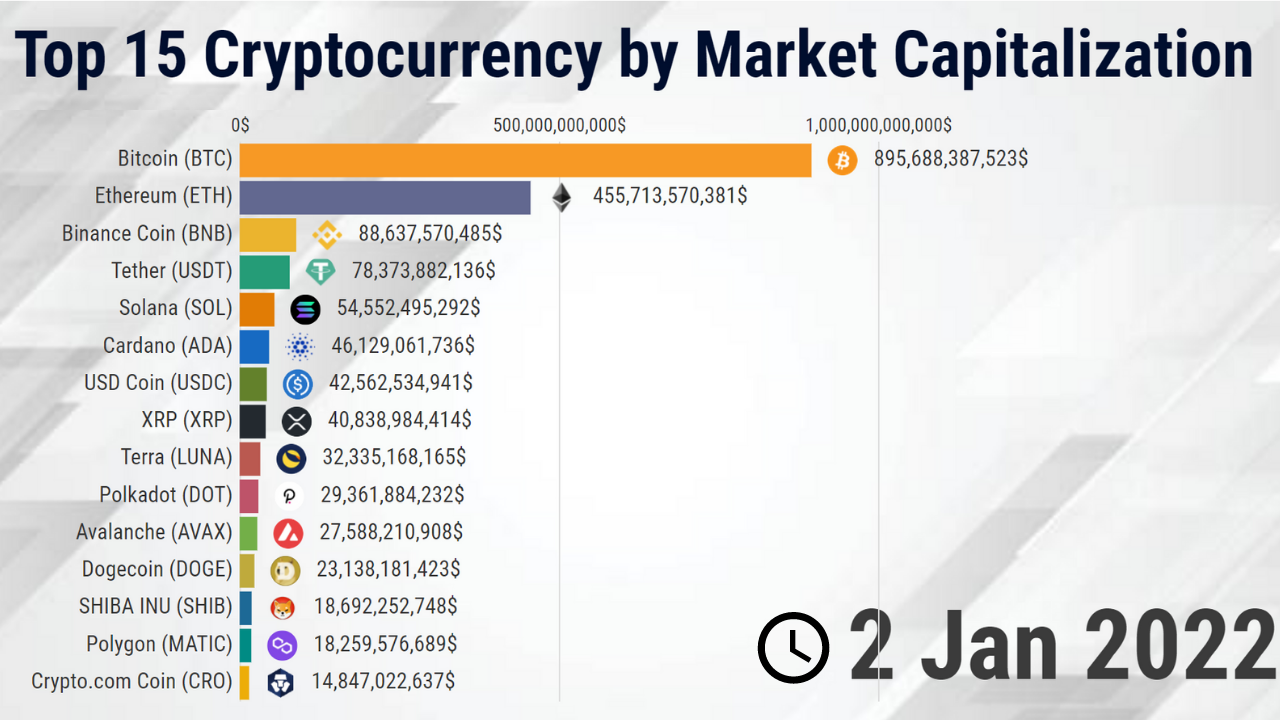

(Image Source: Statistics & Data)

While there are some who welcome the dip as a gift from the year-end slump, for others it’s not exactly what they were hoping for.

What Caused This Dip?

While the price of Bitcoin and other cryptocurrencies have gone up dramatically, the amount of money being lost by people who are holding coins has skyrocketed. You can blame Bitcoin for this – as its value goes up, so do the prices of everything else that exists on the market. When it comes to problems that exist in all types of investment markets, it’s impossible to tell what will happen next. The only difference between cryptocurrencies and other financial instruments is that they are decentralized, meaning they don’t have a central authority like banks or governments overseeing them, which means nobody knows when or where things will take a turn for the worse (or better).

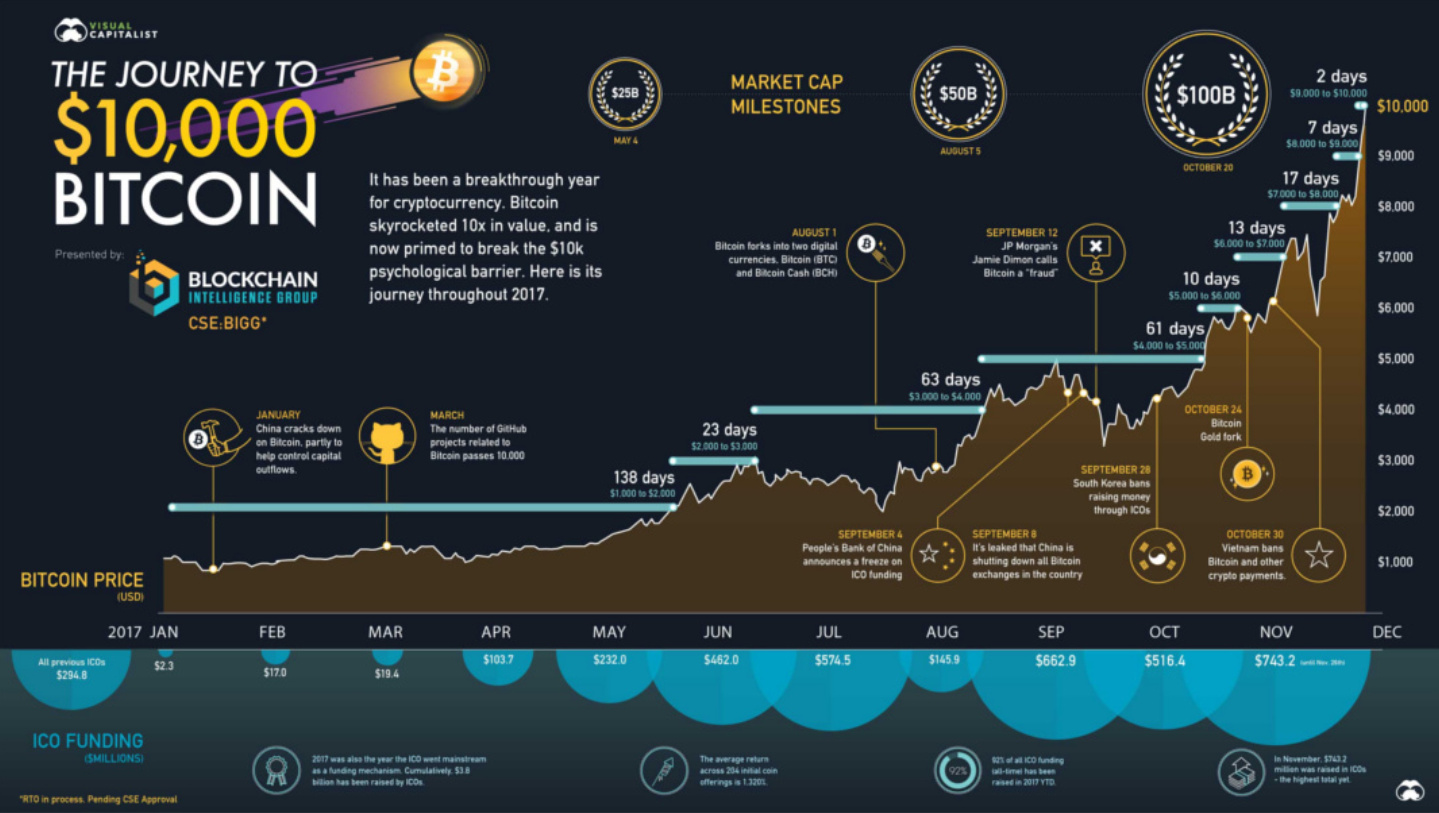

(Image Source: Visual Capitalist)

Cryptocurrencies have been around for a long time, but this is the first year where the number of people investing in them has increased. The reason for that has a lot to do with Bitcoin’s popularity and mobile technology which enables investors to keep track of the market. With the latest introduction of 5G internet, it has become easier to invest, track and sell cryptocurrencies. Considering the fact that there are numerous crypto investment apps on the App Store and Google Play, it now takes less than 5 minutes to get involved with crypto.

As more people get involved with the original cryptocurrency, it’s understandable that other altcoins would feel threatened by such success. After all, the development of Ethereum and other altcoins has been driven almost entirely by one man: Vitalik Buterin. As you might know, there was a limited number of Bitcoins available when Ethereum was developed, so many people started investing in Bitcoin as an alternative cryptocurrency and transferred their investment into Ethereum to increase its value.

The Cryptocurrency Freeze

All of this is known as the crypto freeze. The idea of having a digital currency that isn’t issued by a central authority is something that has been around for decades and has been tried in many different ways, but has never succeeded so well as the original cryptocurrency developed by the mysterious Satoshi Nakamoto. A lot of people don’t actually know why this happened, but there are many factors that can be identified. For example, everyone knows about Bitcoin’s scalability issues, which have led to high transaction fees and long transaction times. This means that Bitcoin transactions take much longer than they should otherwise take if there wasn’t some sort of limitation on how quickly they could be processed. A lot of people are looking to Bitcoin Cash as an alternative to the original cryptocurrency, which means that they are investing in a digital currency that is similar to the original but has addressed the scalability issues.

Cryptocurrencies are very volatile, which means that any changes in their value can cause a significant amount of fluctuation. Unlike traditional financial instruments, cryptocurrencies aren’t regulated by any government or central authority. This means there’s no mechanism for things like an insurance policy for users who lose money when things go wrong (like with banks). While this gives users more control over their funds, it also adds a layer of risk because there’s nobody to turn to in case something goes wrong.

The future of crypto

A “crypto crash” is expected, and companies in the crypto world have been preparing for this for quite some time. The price of Bitcoin started the year with a bang, reaching an all-time high. This latest bull run has led many new investors into the booming cryptocurrency market and drawn even more attention from mainstream investment media outlets.

With the total market cap of all cryptocurrencies surpassing $2.1 trillion, not to mention the relative ease with which one can access these markets, it’s clear that a lot of people have missed out. The good news is that as more time passes and more and more people become familiar with how Bitcoin and other cryptocurrencies work, the price is bound to rise.

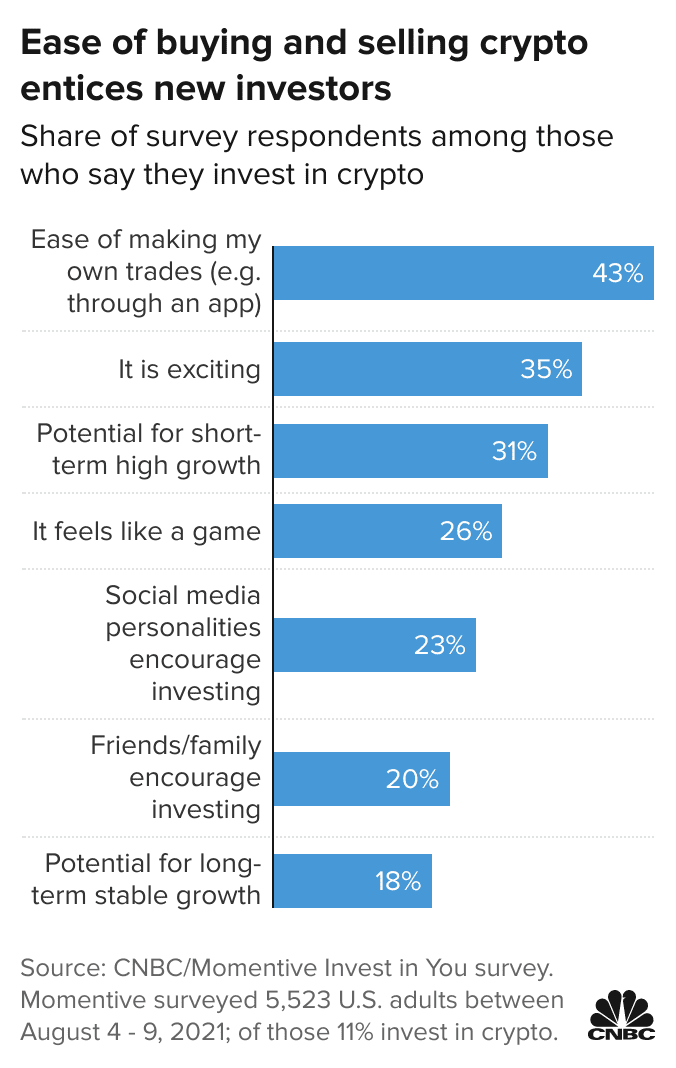

(Image Source: CNBC)

Naturally, the crypto community is growing, with crypto exchanges exploding in popularity. The growth of these platforms has led to an increase in the trade volume of virtually every coin listed on them as well as increased interest from investors and entrepreneurs looking to get into the cryptocurrency game.

That’s a good thing. Having more people involved in the cryptocurrency market means that more money is spent, which makes the price go up. The problem is that not everyone knows how to invest in crypto, which leads to a few problems.

Most are looking to profit from the upswing. That may sound simple enough, but some investors will enter crypto expecting to make money by investing in new coins before they even really “hit it big” or start using those coins for real-world purchases. This is a mistake and it can lead to losses very quickly if they fail to recognise the potential pitfalls. The problem is that most of these investors don’t understand the risks involved with cryptocurrency. While it’s true that many people are making a large amount of money by investing in cryptocurrencies and getting involved in the market while it’s still young, there is a real risk associated with these investments.